i-SINAR OPEN TO ALL EPF MEMBERS WHOSE INCOME IS AFFECTED BY COVID-19

- Eric Lee

- Dec 5, 2020

- 3 min read

After going through much debate both among the Malaysian public and within Parliament, the Employees Provident Fund (EPF) has finally released the finalised details on its much-awaited i-Sinar Akaun 1 withdrawal facility. From how to apply to how much money you can withdraw, here are some frequently asked questions – and their answers – on the EPF i-Sinar facility.

What is i-Sinar?

i-Sinar is the name of the facility that allows affected members of the EPF to withdraw a set amount of funds from their Akaun 1, in order to help with cash flow issues during the Covid-19 crisis.

What is EPF Akaun 1?

Your EPF contributions are split into two different accounts: Akaun 1 and Akaun 2. Traditionally, funds from EPF Akaun 1 can only be accessed upon retirement and cannot be withdrawn for any other reason. Meanwhile, funds from Akaun 2 can be partially withdrawn before retirement for a number of reasons, including for education and buying a home.

How much money can I withdraw from i-Sinar?

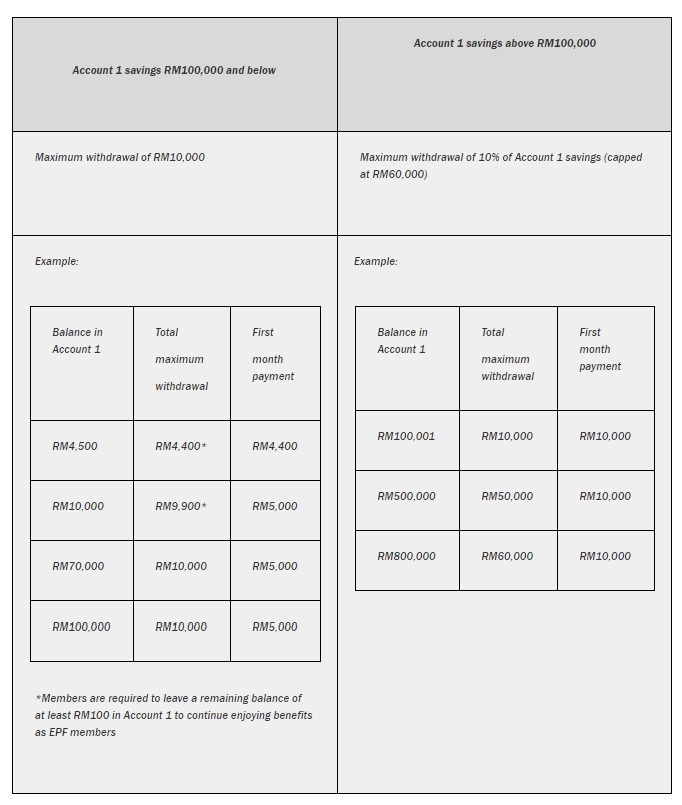

The amount of money you can withdraw from i-Sinar depends on how much balance you have in your Akaun 1, and can be referred to below.

A. For those with RM100,000 and below in Account 1, they can withdraw any amount up to RM10,000. Payments will be staggered over a maximum period of six (6) months with the first payment of up to RM5,000.

B. For those who have above RM100,000 in Account 1, they can withdraw a maximum 10% of their Account 1 savings, up to RM60,000 (whichever is lower). Payments will be staggered over a maximum period of six (6) months with the first payment of up to RM10,000.

Note that all withdrawals are also subject to maintaining a minimum balance of RM100 in Akaun 1. Here’s a summary from the EPF to help you better understand the mechanics of the i-Sinar facility:

Who can apply?

The eligibility criteria is as follows:

Category 1

Eligible members include workers in the formal sector, self-employed workers and workers in the gig economy, those who have not contributed to the EPF for a period of time, have lost their jobs, housewives, or given no pay leave.

The criteria for Category 1 is as follows: 1. Members who have not contributed to the EPF for at least two (2) consecutive months on application; OR 2. Members who are still working but have suffered a reduction of their base salary by 30% and above from March 2020 onwards. For this category:

· Supporting documents are not required;

· Approval is automatic based on EPF’s internal data;

· Members will only need to apply online via isinar.kwsp.gov.my beginning 21 December 2020.

Payment for eligible members under this category will be done from the middle of January 2021. Category 2

This category includes members whose total income has been reduced by 30% and above (total income including base salary and other benefits such as allowances and overtime) from 1 March 2020 onwards, whereby the said reduction can only be verified with supporting documents. To expedite the verification process, the EPF will require supporting documents from members as stated below:

· Salary slip before and after reduction of income; and

· Employer’s notice of suspension or reduction of allowances and/or overtime claims.

For members who are not able to provide the supporting documents as mentioned above, other relevant supporting documents such as bank statement or employer’s written acknowledgement will be given due consideration. Members who fall under this category can start applying online via isinar.kwsp.gov.my beginning 11 January 2021. To ensure due consideration is given for applications, member’s application status will be notified to members within two to three weeks after their application is submitted. Payment will be done before the end of the following month, after the application is approved.

Comments